Options for financing your weight loss surgery include:

- Private medical insurance

- Medicare or Medicaid

- Payment plan through your surgeon

- Secured medical loan

- Unsecured medical loan

- Retirement plan loan

- Life insurance policy loan

- Loan from your family or friends

The page below provides greater detail about each topic.

TABLE OF CONTENTS

Click on any of the topics below to jump directly to that section

- How Patients Pay

- Tax Considerations

- Check Your Insurance

- Cost Without Insurance

- Financing Options

- Patient Community & Expert Advice

- Find a Weight Loss Surgeon

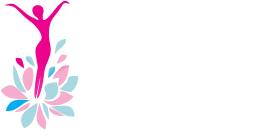

How Patients Pay for Surgery

SECTION SUMMARY:

- Private medical insurance: 80% of patients

- Medicaid: 8% of patients (many surgeons do not accept Medicaid)

- Financing/Self Pay: 6% of patients

- Medicare: 6% of patients

To date, those patients who have undergone bariatric surgery have been able to get insurance coverage about 88% of the time.

As you can see, the majority of patients get coverage through private insurance, Medicare or Medicaid.

While 88% of patients getting insurance coverage seems high, it still means that 12% had to pay for it out of their savings or find bariatric surgery financing.

Equally as important, these percentages do not include all individuals who are eligible for surgery, but merely those who actually go through with it; 35% of patients who are eligible for bariatric surgery are either uninsured or underinsured (2). Unfortunately, this means that there are many people out there who need help and just aren’t getting it.

This is where financing bariatric surgery comes in.

Further down the page, we’ll discuss all of your insurance and financing options and help you figure out which options could work for you, but first you should understand how bariatric surgery tax treatment can help.

Tax Benefits

SECTION SUMMARY:

- Your bariatric surgery may be tax deductible

- There are tax-favored savings accounts to help offset costs

“You’re allowed to deduct medical expenses as long as the costs are higher than 7.5% of your adjusted gross income.”

It’s important to keep the tax angles in the back of your mind while financing bariatric surgery.

Bariatric surgery IS tax deductible which can have a big impact on the total cost of surgery. Throughout the United States, tax subsidies reduce medical costs for the non-elderly by over $208 Billion annually ( 3).

The official IRS rules state that you’re allowed to deduct medical expenses as long as the costs are higher than 10% of your adjusted gross income.

In order to receive the deductions, you’ll need to complete Schedule A of the IRS Form 1040. You’ll also need to save your medical bills and payment statements as proof. Note that any reimbursed amounts (such as the amount that insurance paid) cannot be included.

Finding a good accountant or using an effective software program will make this process much easier. These guides can also help ensure that that you deduct as much as possible without violating any IRS laws.

Depending on your employment status, money accrued in special savings accounts (or even your IRA) could also be a bariatric surgery financing option…

Health Savings Account (HSA)

Individual, Small Business or Large Employer (50+ employees) – HSAs can only be opened alongside a “qualified high deductible” health plan. Money contributed to an HSA, accumulated interest from the accounts where the money is invested AND money taken out of the HSA to pay for qualified medical expenses are all TAX FREE. No other account receives more favorable tax treatment. You may even be able to transfer money already in your IRA to an HSA. See the IRS’s Site for more info.

Unused HSA savings can also be taken out without penalty as retirement income after a certain age. See our retirement plan section below for more about using retirement money for financing bariatric surgery.

Archer Medical Savings Account (Archer MSA)

Small Business – Archer MSAs are very similar to HSAs, except they are for self-employed individuals or small businesses. Click here for the details.

Health Reimbursement Account (HRA)

Large Employer Only (50+ employees) – HRAs can only be offered by your employer, and only your employer can contribute money to them. If your company offers one, make sure your plan allows the use of HRA funds to pay for “all qualified medical expenses” as financing bariatric surgery is not allowed with some plans. More info can be found by clicking here.

Flexible Spending Account (FSA)

Large Employer Only (50+ employees) – Both employers and employees can contribute to an FSA, also known by its IRS code, “Section 125”. FSA’s can be offered alongside any health plan, and withdrawals from this account can be made tax-free as long as they are used to pay for qualified medical expenses. Click here to get the summary from the IRS.

Check Insurance Coverage

SECTION SUMMARY:

- Check your individual/family medical insurance

- Check your insurance through your employer

- Medicare & Medicaid both cover bariatric surgery

While you’re still likely to have some out-of-pocket costs by financing bariatric surgery with insurance, getting Medicare, Medicaid or your private insurance (employer-paid, small business or an individual policy) to pay will probably be your least expensive option.

Financing bariatric surgery can also be an option if you need help paying out of pocket costs such as deductibles or co-pays (see our Financing Without Insurance section below).

In addition, you may be able to collect disability insurance payments while you’re having and recovering from surgery.

If you have medical or disability insurance, click one of the links below to check if your policy covers weight loss surgery.

- Private bariatric surgery insurance through your employer or individual/family coverage

- Medicare bariatric surgery coverage

There we will help you figure out…

- The process for getting the surgery approved

- If your plan doesn’t cover surgery, how you may be able to get it added

- How to write an effective health insurance appeal letter if your insurance company denies coverage

Cost Without Insurance

SECTION SUMMARY:

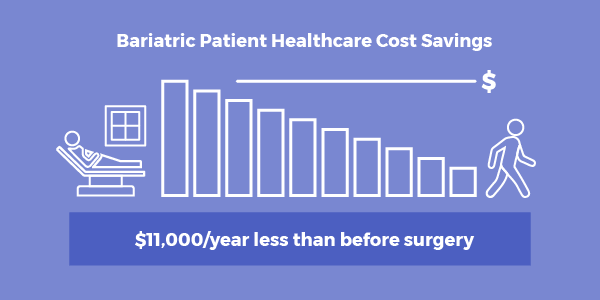

- Cost of Surgery Vs. Remaining Obese: having surgery saves you $11,000 per year

- Surgery Costs: $8,000 to $27,000, depending on the procedure

"As early as 13 months after surgery, bariatric patients spend as much as $900 per month less than morbidly obese people who don’t have bariatric surgery."

Financing bariatric surgery on your own is well worth it for a few big reasons:

- Improving or eliminating obesity health problems – as our Life After Weight Loss Surgery page shows, bariatric patients live longer, have an improved quality of life after surgery, and eliminate or improve numerous major health problems.

- Eliminating obesity discrimination – Unfortunately, being extremely overweight often makes people to treat you differently. It has even been shown to cause you to earn less money at work. Successful bariatric surgery improves this 100% of the time.

- Long-term financial savings – If you have no insurance or if you have insurance with high out of pocket costs, you will save a lot of money over the long run due to lower medical costs following surgery.

On average, the costs incurred from 1 month before surgery through 2 months afterwards were about $24,500. Beginning at 3 months after surgery, bariatric patients start saving compared to those who didn’t have surgery.

As early as 13 months after surgery patients spend as much as $900 per month less. The analysis showed that for those receiving laparoscopic bariatric surgery, costs of surgery broke even within 2 years. Those receiving open surgery broke even within 4 years ( 4).

The average cost of bariatric surgery depends on which procedure you choose. It ranges from $8,000 to $27,000 without insurance and from $3,500 to $18,500 with insurance.

Click Here to See How Much Your Procedure Will CostWill Surgery Complications Be Covered by Your Insurance?

While the likelihood of death is low after bariatric surgery, short- and long-term complications can occur.

If your insurance does not cover weight loss surgery, in all likelihood it won’t cover complications resulting from surgery either. However, emergency treatment will always be covered, regardless of the cause.

Before paying cash or setting up financing, ask your surgeon who will cover the cost of complications should they arise. Some surgeons include costs of complications in their bundled price while others do not.

Financing Without Insurance

SECTION SUMMARY:

- A payment plan through your surgeon’s office

- A secured medical loan

- An unsecured medical loan (brokers, direct lenders, & credit cards)

- A retirement plan loan

- A life insurance policy loan

- A loan from your family or friends

- You could travel to a less-expensive location for surgery

1. Payment plan through surgeon

Most surgeons offer some kind of payment plan to make treatment affordable. Some allow you to pay them interest-free over time, while others will agree to charge you a very low interest rate. Some even offer reduced-cost or free weight loss surgery for those who can’t afford it.

While you are negotiating, do not be confused by doctors offering a payment plan through unsecured credit card companies – this is not the same thing (more on this below).

If your surgeon is willing to work with you, your financing bariatric surgery plan will almost always be set up on a one-off basis. Always negotiate a fully packaged up-front price for all services so there are no surprises down the road.

A packaged price will typically include:

- Hospital fee – be sure to confirm how many nights in the hospital are included. Up to 2 nights is common.

- Surgeon fee

- Anesthesia fees

- Routine follow-up visits (including fills for the lap band) – the timeframes will vary, but including follow-up visits for the 12 months following surgery is standard.

Services often not included in the packaged price (that you will have to pay for on top of the packaged price) include:

- Pre-operative testing – note that some surgeons DO include this in the packaged price.

- Pre-operative visits, including consultations with the surgeon, dietitian or nutritionist, fitness consultant, psychologist and other professionals.

- Surgical assistant fees

- Radiologist fees

Even though these may not be included, your surgeon can still provide you with an estimate of what they will cost. The information they provide may not be all-inclusive, so talk with them about what other charges may arise. These estimates can also be taken into consideration when seeking other options for financing bariatric surgery.

Free Seminars & One-on-One Consultations

Most surgeons offer free seminars and/or one-on-one consultations that teach you about your surgery and financing options.

It’s free, so schedule this now to learn your local financing options before considering alternatives.

If you have money saved up to pay for all or a big chunk of the surgery up front, why not try to delay the payments so you can earn interest on what you’ve saved? The interest you earn in a low-risk investment can help pay for the surgery (if this doesn’t apply to you, click here to jump past the example).

For example, let’s assume that your total surgery costs (assuming no complications) are $25,000. For simplicity’s sake and to illustrate the potential, let’s also assume that:

A) Your surgeon agrees to spread your payments out over 5 years with no money down up front (so you would have to pay $5,000 at the beginning of each year starting in the 2nd year) and no interest

B) You have the full $25,000 saved up and ready to invest

C) You paid the $5,000 at the end of each year

D) You invest the full $25,000 in a Certificate of Deposit (CD) that earns 2% interest per yearWith the above example, you just reduced the cost of your surgery by $1,500 (6%).

If your surgeon agrees to financing bariatric surgery with no interest rate, then it’s a no-brainer. If they do charge an interest rate, it still may be worth it if you can find a safe investment that pays you a higher rate.

| Year | Payment | Savings Invested | Annual Interest You Earn (2% of Savings Invested) |

|---|---|---|---|

| Year 1 | $0 | $25,000 | $500 |

| Year 2 | $5,000 | $20,000 | $400 |

| Year 3 | $5,000 | $15,000 | $300 |

| Year 4 | $5,000 | $10,000 | $200 |

| Year 5 | $5,000 | $5,000 | $100 |

| Year 6 | $5,000 | $0 | $0 |

| Total | $25,000 | $75,000 | $1,500 |

2. Secured Medical Loans

A secured medical loan is a loan from a bank or credit union that you back with some sort of collateral. If you don’t pay the loan back, the financial institution has a right to take ownership of whatever collateral you used.

By far the most commonly accepted form of collateral is your home (also called a mortgage loan).

If you own your home and have at least 10 to 20% of equity built up, a secured loan may be an option for you.

However, due to the complexity of a secured loan (they require a refinance of your home), many patients choose unsecured medical loans instead (discussed further down the page) for loan amounts of $15,000 or less.

See our Secured Medical Loans page for more information.

3. Unsecured medical loan (brokers, direct lenders, & credit cards)

Importance of Credit

Your credit report and score will affect both the types of loans available to you and the rate you are charged. Learning what your credit score is before applying for a loan and which factors (if any) are bringing down your score can help you figure out:

- How likely you are to get approved

- How competitive your rate is likely to be

- Whether any items on your credit report are inaccurate or could be removed to improve your score

Unlike secured loans, unsecured loans allow you to borrow money without putting up any collateral. The trade off comes in the form of an interest rate that you pay back to the bank over the term of your loan.

There are three ways to obtain an unsecured medical loan, including:

- Brokers, who work with multiple lenders on your behalf

- Lenders (directly)

- Credit cards (typically the most expensive kind of unsecured loan)

See our Unsecured Medical Loans page for a complete analysis, including comparisons of your broker and lender options.

4. Retirement plan loan

Generally speaking, you should never touch your retirement savings if at all possible. There is no telling how long Social Security will be around, and either way, you will most likely need more than what Social Security will pay you to maintain your current lifestyle.

In addition, whatever money you take out of your retirement plan will no longer have the potential to make money for you in the form of investment returns, and when compounding interest is factored in, it really makes taking money out feel painful.

On the flip side, what is the point of having money in the bank if you are not around to spend it due to obesity-related health problems?

After you crunch the numbers and compare interest rates and long-term costs (and potential lost retirement plan returns depending on how aggressively you are invested), you may discover that this is the best option for financing bariatric surgery.

Your first step is to contact your HR department or your retirement plan provider to find out whether you plan allows hardship withdrawals. Hardship withdrawal provisions allows you to to take out money from your retirement plan for unreimbursed medical expenses for you, your spouse or your dependents.

The IRS discourages these withdrawals by imposing a 10% early withdrawal penalty (they keep 10% of whatever funds you withdraw) and by applying your withdrawal amount to your taxable income.

However, you may be able to get the 10% penalty waived in certain situations such as:

- Becoming totally disabled.

- Being in debt for medical expenses that exceed 7.5% of your adjusted gross income

5. Life insurance policy loan

The main purpose of life insurance is obviously the death benefit. But a form of life insurance called “permanent” life insurance also offers benefits while you’re alive. One of those benefits is the accumulation of a “cash value” that can be borrowed against.

If you already have permanent life insurance, this may be an option for financing bariatric surgery. If you don’t, it will probably take years to accumulate enough cash value to pay for the surgery so this may not be an option for you (click here to jump to the next financing bariatric surgery option if you don’t already have permanent life or are not willing to wait to have surgery).

Here’s how it works…

- You choose the level of monthly premiums that you are going to pay for the permanent life insurance. At the lowest payment option, there is no cash value accumulation – you’re only paying for “term life,” which only has a death benefit.

- The higher your premium, the more quickly the cash value will build up. The intricacies of permanent life are beyond the scope of this article, but it is worth noting that it takes some time for the cash value to accumulate. In addition, the cash

value does not build at a “1 to 1” rate.

In other words, if the “term life” premium is $75 per month and the “permanent life” premium is $125, you will not have $50 ($125 – $75) in cash value after the first payment – you’ll have much less. But over time the cash value catches up and surpasses your additional premiums and eventually becomes large enough that it can cover your term life payments for the rest of your life (that is, if you didn’t take the cash value out to pay for surgery or anything else). - Once you have accumulated cash value, you can take a loan out up to the amount of the cash value.

- The loan has to be paid back to your account with interest.

It is important to know that if you pass away while the loan is outstanding, the amount due will be deducted from the death benefit. This could leave your loved ones in a tight spot.

There are also several other issues that arise should you default on the loan, so discuss this option with a good financial planner, insurance broker or life insurance representative before proceeding.

6. Loan from family or friends

This option is obviously going to vary widely from person to person, but it should be considered.

Financing bariatric surgery by borrowing money from friends and family can save you the interest that banks will charge which can amount to thousands of dollars. And you may be surprised how willing your loved ones are to help, especially after you educate them about bariatric surgery’s impact to your obesity health issues.

Take a look at this ABC News story about a weight loss surgery patient who got help financing bariatric surgery from her family and friends.

7. Medical travel

Before we dive into medical travel (inaccurately referred to as "medical tourism"; top-notch medical care should be the focus, NOT tourism), there are a few questions you should consider.

If it meant saving a lot of money and receiving top-notch medical care…

- Would you be open to getting on a plane to have surgery out of your area?

- Do you have someone close to you that would be willing to go with you?

- If your own research proved to you that it is completely safe and effective, would you still be comfortable doing something if your local primary care or bariatric doctors advised against it?

We’re not suggesting that your doctor’s advice isn’t good. Getting treatment out of the area certainly adds a level of complexity to their jobs by forcing them to interact with doctors they don’t know. And your doctor may genuinely be uncomfortable recommending care in a place they are unfamiliar with.

But many U.S. doctors, especially bariatric surgeons, are not excited about this “new angle” of competition regardless of how safe, effective or inexpensive it is. Remember, in addition to being doctors, they’re also trying to run a profitable business. Would you be excited about referring your customers to competition that provides the same service for as low as 1/4 the cost?

If you answered yes to all of the above, the cost savings alone – which could be up to $20,000 or more – may warrant your review of this increasingly viable option for financing bariatric surgery.

After getting an initial understanding of the costs, click here to learn more about surgery abroad (page includes weight loss surgery Mexico).

Patient Community & Expert Advice

SECTION SUMMARY:

- You can read about the experiences of other patients financing their surgery

- You can “Ask the Expert”

Your bariatric surgery financing advice will help other patients figure out how to afford their life-changing surgery (click here to review contributions from other visitors).

Please include any information that you think applies, such as…

– Which procedure did you have?

– Where did you receive surgery (clinic/surgeon, city, state/province, country)?

– How much did it cost?

– How much, if any, did insurance pay?

– How did you pay for your (non-insurance) portion of the costs?

– What were the terms of your financing?

– Did you negotiate, or were the terms set in stone?

– Did you have any problems?

– Any key advice?

Questions From Other Visitors*

Click below to see contributions from other visitors to this page.

How do I qualify for weight loss surgery so that insurance will pay for it? I am a 57 years old with a history of chronic back pain, depression and…

I need weight loss surgery but can't afford it*I am a 39 yr old who has been desperately needing weight loss surgery but I am cut down every way I turn because I'm told that I don't have…

I Need Help Paying for Weight Loss Surgery*I am looking for a reliable source to help me cover the cost of the Gastric Sleeve procedure. I meet all the requirements for the procedure however my insurance does…

Financing Lap Band Surgery & Follow-Up Visits in Lump Sum*I had lap band surgery in December 2009. I had consulted with my GP to see whether I qualified to have it carried out under the British National Health System,…

Contact a Weight Loss Surgeon

SECTION SUMMARY:

- You can ask a local bariatric practice for a free insurance check or cost quote

- You can attend a free in-person seminar or an online webinar offered by a local weight loss surgeon

- You should schedule a phone or in-person consultation (both often free), if you are interested in learning more about weight loss surgery