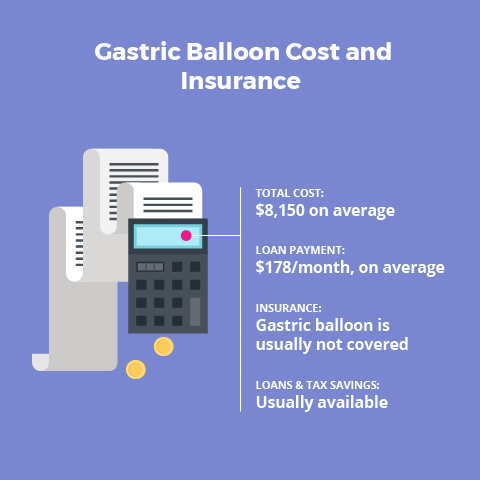

The average gastric balloon cost is $8,150. It is usually not covered by insurance, although your doctor may be able to get some of the costs covered.

The price can often be reduced through tax deductions and special doctor-specific discounts.

This page covers everything you need to know about paying for the gastric balloon procedure.

TABLE OF CONTENTS

Click on any of the topics below to jump directly to that section

- Cost By Device Manufactur

- Cost By Country

- Cost Vs Other Weight Loss Procedures

- Cost Breakdown: Pre-Op, Surgery, & Post-Op

- Insurance Considerations

- Possible Discounts

- Financing

- Tax Savings

- Find a Gastric Balloon Doctor

SECTION SUMMARY:

- The cost varies by device manufacturer (Orbera, Reshape, Obalon)

- It’s about $8,000 for each

There are currently 3 FDA-approved gastric balloon types in the United States. Following is the average cost for each type:

- Orbera gastric balloon cost (single balloon, inserted through mouth): $8,150

- ReShape gastric balloon cost (dual balloon, inserted through mouth): $8,000 (1)

- Obalon gastric balloon cost (triple balloon, swallowed in “pill” form): $6,000 to $9,000 (2)

Final costs vary by region and practice.

Click here to contact a gastric balloon doctor for quote.

For a complete comparison of each device, see our Types of Gastric Balloons section.

SECTION SUMMARY:

- Gastric balloon cost varies by country

Following are the results of our annual gastric balloon price survey by country:

Free Insurance Check & Cost Quote: Click here to contact a gastric balloon surgeon

SECTION SUMMARY:

- Gastric balloon has the lowest self-pay cost

- If your insurance covers bariatric surgery, other procedures may cost less than the gastric balloon

Gastric balloon has the lowest total cost out of all available types of weight loss surgery. It has the 3rd highest cost for patients with insurance.

Click Here to See a Cost Comparison ChartFree Insurance Check & Cost Quote: Click here to contact a gastric balloon surgeon

See our Types of Bariatric Surgery page for a full comparison.

SECTION SUMMARY:

- Pre-Op costs

- Balloon insertion procedure costs

- Post-Op costs

Below are all potential gastric balloon cost categories:

Pre-Op (Costs Before Procedure)

- Dietitian/nutritionist consultations

- Psychologist (mental health clearance)

- Cardiologist (heart health clearance)

- Lab/blood work, echocardiogram (also known as an “ECG” or “EKG”) and/or X-Ray fees

- Surgeon consultation fees

Standard Costs During Procedure

- Device fees (the cost of the balloon itself)

- Hospital fees

- Surgeon fees

- Surgical assistant fees

- Anesthesia fees

- Operating room fees

Non-Standard Costs During Procedure (May Carry Extra Costs)

- Pathologist fees (for reviewing biopsies, if necessary)

- Radiologist fees (for reviewing x-rays, if necessary)

Post-Op (Costs After Procedure)

- Addressing any complications

- Follow-up doctor visits

- Bariatric vitamins

- Extra food costs (healthier food tends to cost more)

- Personal trainer and/or gym membership

- New clothes (wait to go crazy with this until you reach your plateau weight)

- Plastic surgery to remove sagging skin (more on this in the Downsides section below)

SECTION SUMMARY:

- The balloon insertion procedure is usually not covered by insurance

- Your doctor may be able to get insurance to pay for some of the costs

While approved for use in most countries, including the United States, Canada, Australia and the United Kingdom, the intragastric balloon is not typically covered by insurance other than in the UK.

United States: Usually Not Covered

In the United States, most insurance policies, including those from Medicare and most major insurance companies, specifically exclude the intragastric balloon from coverage because it has not been around long enough.

For example, Medicare states it is not covered because “the long term safety and efficacy of the device in the treatment of obesity has not been established.” (6)

However, it is possible that your surgeon’s office can help you get your insurance company to cover some or all of your procedure, depending on your circumstances.

Free Insurance Check: Click here to contact a gastric balloon surgeon. Most offer a free insurance check for qualifying patients.

Canada: Not Covered

Unfortunately, Canada’s national health insurance program does not currently cover the gastric balloon.

Australia: Usually Not Covered

In Australia, your Health Fund may cover part of the procedure (such as the gastroscopy) but will probably not cover the majority of the costs.

United Kingdom: May Be Covered

In the UK, the National Health Service (NHS) may cover the procedure if you can prove that your weight is impacting your health to a large enough degree. This determination is made on a case-by-case basis and may take several months.

SECTION SUMMARY:

- 6 discounts to ask your doctor about

Ask your surgeon if any of these discounts are available:

- Self-Pay Discounts. Most surgeons offer self-pay discounts or payment plans. Just ask!

- Other Discounts. Some offer discounts if you pay the total amount you owe in advance.

- Same Surgeon, Different Hospitals. Some surgeons operate at more than one hospital. Hospital costs make up the biggest part of the bill, so find out if your surgeon has a choice.

- Pre-Op Costs. Some surgeons include pre-op costs in their quoted fees. Pre-op costs include things like testing and office visits.

- Complications. Complications, should they arise, may increase total costs. Find out who will pay if one arises during surgery. Some surgeons will include the cost of any complications in their quote while others will charge extra.

- Health Insurance. You may still get insurance to pay for some costs that could be applied to covered treatments. For example, lab work is needed for many reasons unrelated to the gastric balloon. Your surgeon can help you find the savings opportunities in your plan.

SECTION SUMMARY:

- 7 ways to make the procedure more affordable

Gastric balloon loans are available almost everywhere to help pay for:

- The entire cost of surgery

- The part that insurance doesn’t cover, like deductibles, copays, or coinsurance

The full list of financing options to make gastric balloon more affordable include (click links for more information):

- Payment Plan Through a Qualified Surgeon

- Brokers, Direct Lenders, and Credit Cards (Unsecured Medical Loans)

- Friends & Family

- Secured Medical Loans

- Retirement Plan Loans

- Permanent Life Insurance Loans

- Medical travel – having surgery in a location that is less expensive than where you live

Gastric Balloon Loan Application: Click here to contact a gastric balloon surgeon to discuss your loan options

For more information about each of the above financing options, click here.

SECTION SUMMARY:

- The procedure is tax deductible if you meet income requirements

- The procedure can be paid for with special tax-favored accounts

United States: Might Be Deductible, Special Tax-Favored Accounts Available

Gastric balloon is tax deductible – you can deduct all medical expenses if the costs are more than 10% of your adjusted gross income.

To receive the deductions, you’ll need to complete Schedule A of the IRS Form 1040. You’ll also need to save your medical bills and payment statements as proof.

Money in special savings accounts (or even your IRA) may also be a way to pay for part of surgery tax-free:

- Health Savings Account (HSA) – You can open an HSA alongside a “qualified high deductible” health plan. Tax-free HSA money can be used pay for qualified medical expenses. No other account receives better tax treatment. You can even transfer IRA money into an HSA. See the IRS’s Site for more info.

- Archer Medical Savings Account (Archer MSA) – Archer MSAs are like HSAs for the self-employed or small businesses. Click here for details.

- Health Reimbursement Account (HRA) – HRAs are only offered by employers who set them up and contribute money to them. If your company offers one, make sure your plan allows the use of HRA funds to pay for “all qualified medical expenses.” Click here for more info.

- Flexible Spending Account (FSA) – Both employers and employees can contribute to an FSA, also known by its IRS code, “Section 125”. Money from them can be taken out tax-free if it is used for qualified medical expenses. Click here to get the summary from the IRS.

Canada: Is Deductible

Canada is generous compared to other countries when it comes to medical tax deductions. If you have a prescription, receipt, or other documentation, you can write them off.

If surgery is covered by your insurance, you can still deduct your:

- Out-of-pocket expenses

- Monthly insurance premium.

If your income is below a certain amount, you may qualify for a tax credit called the refundable medical expense supplement.

Australia: Might Be Deductible

You can write off your bariatric surgery expenses if the costs are over the Australian Taxation Office (ATO) threshold.

According to the ATO:

“To claim the net medical expenses tax offset in your tax return, you will need to know the total medical expenses you incurred for yourself and your dependants. You then deduct any refunds from Medicare, your health fund or any other reimbursements that relate to those expenses received during the financial year.”

Click here for updated Medicare Benefit Tax Statement information from the Department of Human Services.