Bariatric surgery insurance coverage varies by insurance policy. If your policy covers weight loss surgery and you meet the qualification requirements, most plans will pay for you to have gastric sleeve, gastric bypass, Lap-Band, or duodenal switch surgery.

Your costs with insurance can be as low as $0, depending on your policy. However, most insurance plans require the patient to pay part of the costs in the form of copays, deductibles, and coinsurance.

Click Here to Check Your InsuranceRead and click below for additional weight loss surgery insurance details.

TABLE OF CONTENTS

Click on any of the topics below to jump directly to that section

Insurance Coverage by Plan Type & State

SECTION SUMMARY:

- Individual/family coverage

- Small employer coverage (Under 50 employees)

- Large employer coverage (50+ employees)

- Medicare & Medicaid coverage

Before searching for your insurance company’s specific coverage requirements for weight loss surgery, you need to know whether your specific policy covers it. Review the following plan types to learn more:

Individual or Family Insurance

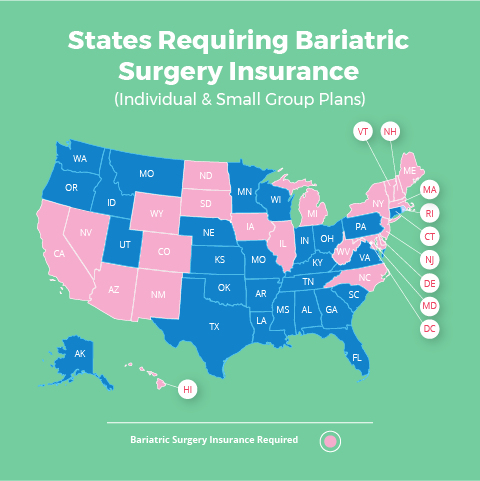

Due to the passage of the Affordable Care Act (Obamacare), insurance companies in 23 states are REQUIRED to cover weight loss surgery for all Individual Plans, Family Plans and Small Group Plans (employers with fewer than 50 full-time employees). The updated list below includes all Affordable Care Act weight loss surgery states.

Obamacare Weight Loss Surgery States (for Individual, Family & Small Group Plans)

- Arizona

- California

- Colorado

- Delaware

- Hawaii

- Illinois

- Iowa

- Maine

- Maryland

- Massachusetts

- Michigan

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Rhode Island

- South Dakota

- Vermont

- West Virginia

- Wyoming

To confirm your coverage, you have a couple of options:

- Option 1 (recommended): Your local surgeon will contact your insurance company to confirm your benefits for free (even if you don’t move forward with surgery). Their office will be very familiar with your insurance company’s requirements and approval process, so it’s usually a good idea to let them do the work for you. Click here to find a local surgeon.

- Option 2: Contact your insurance company yourself and/or check your Summary Plan Description (SPD). See our page on Insurance That Covers Bariatric Surgery for the full list of United States insurance companies, contact information, and bariatric surgery coverage requirements.

If you find out that weight loss surgery is not covered, you still have several options for financing bariatric surgery to make treatment more affordable and to potentially reduce your out of pocket expenses.

For more information about Bariatric Surgery and the Affordable Care Act, see our Obamacare Weight Loss Surgery Page.

If Your Insurance Is Through Work: Small Groups (50 or fewer full-time employees)

Weight loss surgery insurance coverage guidelines for Small Group (50 or fewer full time employees) are the same as for Individual/Family Plans. Click here to jump up to that section.

To confirm your Small Group bariatric surgery insurance coverage, you have a three options:

- Option 1 (recommended): Your local surgeon will contact your insurance company to determine your coverage details for no charge (even if you decide not to have surgery). Their office has been through the approval process with your insurance company many times, so let them work on your behalf to make the process go as smoothly as possible. Click here to find a local surgeon.

- Option 2: Ask your Human Resources (HR) Department whether or not weight loss surgery is an included benefit under your plan.

- Option 3: Contact your insurance company yourself and/or check your Summary Plan Description (SPD). Click here for the full list of United States insurance companies, contact information and bariatric surgery coverage criteria.

If you have short term disability insurance through your employer, also see our section on Disability Insurance. You may be able to receive portion of your monthly salary while you’re having and recovering from surgery.

If Your Insurance Is Through Work: Large Group (More than 50 full-time employees)

If you get your insurance through your work and your employer has 51 or more full time employees, it is completely up to your company to decide whether or not to cover weight loss surgery.

To confirm your coverage, you have a three options:

- Option 1 (recommended): Your local surgeon will contact your insurance company to confirm your benefits for free. Their office will be very familiar with your insurance company’s requirements and approval process, so it’s usually a good idea to let them do the leg work for you. Click here to find a local surgeon.

- Option 2: Ask your Human Resources (HR) Department whether or not weight loss surgery is an included benefit under your plan.

- Option 3: Contact your insurance company yourself and/or check your Summary Plan Description (SPD). Click here for the full list of United States insurance companies, contact information and bariatric surgery coverage policy details.

If you find out that bariatric surgery insurance is NOT included under your plan, you may want to head over to our Weight Loss Surgery Insurance Secrets page to learn how you may be able to get your company to add the coverage.

If you have short term disability insurance through your employer, you may be able to receive portion of your monthly salary while you’re having and recovering from surgery. See our Short Term Disability section for more information.

If You Are Covered by Medicare or Medicaid

Medicare and Medicaid BOTH cover bariatric surgery as long as you meet their qualification guidelines:

- A body mass index (BMI) over 35

- At least one comorbidity (health problem) related to obesity

- Must have documentation in your medical records confirming that previous attempts at medical treatment for obesity have been unsuccessful

If you meet each of the above criteria, Medicare and Medicaid will cover the following procedures:

- Gastric sleeve surgery (laparoscopic only)

- Gastric bypass surgery (open or laparoscopic)

- Lap band surgery (laparoscopic only)

- Biliopancreatic diversion with duodenal switch (BPD/DS) (open or laparoscopic)

To get approved, you’ll need to be referred by your primary care physician or other attending doctor (probably not just a self-referral to a bariatric surgeon). Your surgeon will also need to be in The Centers for Medicare and Medicaid Services (CMS) directory.

Medicaid Coverage & Bariatric Surgeons

Many surgeons do not accept Medicaid due to lower reimbursement levels (they are unable to cover their costs with the lower fees that Medicaid is allowed to pay).

Contact your local surgeon to confirm whether they will accept your Medicaid insurance. If they don’t, ask for a referral to a surgeon who does.

If you have Medicare Advantage, you’ll need to verify that your chosen surgical team and their hospital are in your insurance company’s network. Contact your insurance company directly to find out (click here for a full list of insurance companies and contact info).

See our Medicaid/Medicare Bariatric Surgery page for more information.

Covered Weight Loss Procedures

SECTION SUMMARY:

- Gastric sleeve, gastric bypass, duodenal switch, & Lap-Band are covered under most plans that include bariatric surgery

- Other procedures are usually not covered by insurance but often have discounts, tax savings, & financing available

Most health plans that provide bariatric surgery insurance will pay for the following procedures (assuming you meet their coverage criteria):

- Gastric sleeve surgery

- Gastric bypass surgery

- Gastric banding surgery (lap band surgery)

- Duodenal switch surgery

Most insurance companies will NOT cover:

- Gastric balloon

- AspireAssist

- Experimental procedures

Click here to learn more about the different types of bariatric surgery.

How to Get Approved

SECTION SUMMARY:

- 8 steps to bariatric surgery insurance approval

If your plan includes bariatric surgery insurance, you will need to meet all of your insurance company’s coverage criteria (click here for list of insurance companies) to confirm the "medical necessity" of your surgery.

Assuming you follow all the guidelines and provide complete, accurate information requested by your insurance company, the process from start to finish can take anywhere from one month to one year.

To prove to your insurance company that your surgery is medically necessary, following are the typical steps:

- Minimum body mass index (BMI) requirements to be confirmed by your physician:

- BMI over 40 –OR–

- BMI over 35 with one or more of the following:

- Clinically significant obstructive sleep apnea

- Coronary heart disease

- Medically refractory hypertension

- Type 2 diabetes mellitus

- Complete a medically supervised diet program. Bariatric surgery insurance criteria for the length of the program range from 3 to 7 consecutive months.

- Schedule a consultation with your bariatric surgeon.

- Schedule a consultation with your primary care physician to obtain a medical clearance letter.

- Schedule a psychiatric evaluation to obtain a mental health clearance letter.

- Schedule a nutritional evaluation from a Registered Dietitian.

- Send all of the above documentation to your insurance company along with a detailed history of your obesity-related health problems, difficulties and treatment attempts. The review process typically happens in under one month.

- Insurance company sends approval or denial letter:

- If approved, your surgeon’s bariatric coordinator will contact you for scheduling.

- If denied, you can choose to appeal the denial.

Your surgeon’s office will be very experienced in managing the above process and may have all of the required personnel on staff (e.g. registered dietitian, psychiatrist, bariatric coordinator, etc.).

Click here to access the weight loss surgeon directory to get started. Most offices will check your insurance for free to confirm coverage criteria.

Find a Weight Loss Surgeon

SECTION SUMMARY:

- You can ask a local bariatric practice for a free insurance check or cost quote

- You can attend a free in-person seminar or an online webinar offered by a local weight loss surgeon

- You should schedule a phone or in-person consultation (both often free), if you are interested in learning more about weight loss surgery